Sample Pages Preview

In 2015,Chinese internet finance developed rapidly and healthily,particularly in areas such as internet payment and internet wealth management.Chinese internet finance companies also became leaders globally in internet finance business.However,it cannot be neglected that there existed notable phenomenon of divergent development in different internet finance areas,specifically as follows.

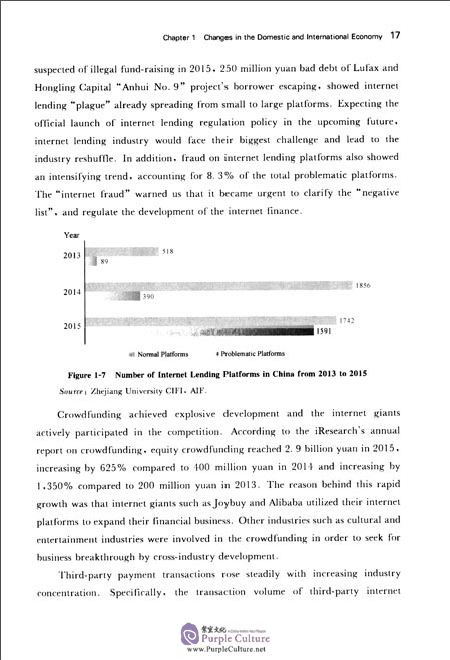

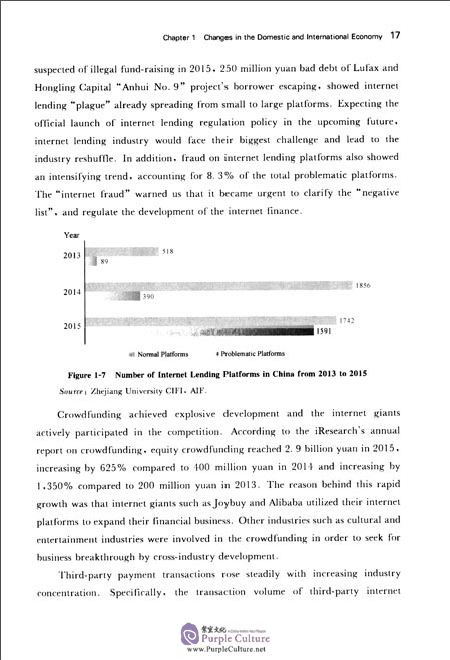

The number or problematic internet lending platforms had been sharply increasing,becoming the"hard—hit area"of internet finance development in China.According to the statistics from Zhejiang University Academy of Internet Finance,the total number of internet lending platforms kept rising.However,the growth rate took a big drop and the problematic platform ratio increased(see Figure 1—7).By the end of 2015,there were 3,333 internet lending platforms cumulatively with the growth rate of 48.4% compared to 2014,which was far below the average annual growth rate of 188.9% since 2007.Furthermore,the number of normally operating platforms declined for the first time compared with 2014,showing the inflection point of the industry.As for those problematic platforms,the problematic ratio of internet lending has been increasing every year,intensifying the reshuffle of the industry.In 2015,there were 1,450problematic platforms operating in China with the problematic ratio of 47.7 %,whereas the problematic ratio was only 17.4% in 2014 and 14.7% in 2013.