Sample Pages Preview

Preface

Preface

Finance for Smart, Green and Sustainable Infrastructure in Asia Home to half of the world's population, Asia economies are vibrant drivers and beneficiaries of globalization. Over the decades, they have increasingly integrated themselves to the global production network, leveraging vast natural and human resources to accelerate the world's economic growth. Their competitiveness in trade stems from infrastructure connections: from expanded sea ports to busy airline gateways, from uninterrupted power supply to well-paved highway networks. Improvements on infrastructure are rewarded with visible socio-economic development.

However, on infrastructure investment, much still need to be done. Rapid economic and demographic growth pose questions for the capacity of existing infrastructure and some regions of the vast Asia are still landlocked and isolated. At the same rime, new digital era calls for smart, green and sustainable infrastructure and recent tendencies toward de-globalization, unilateralism and protectionism raise new challenges to Asian economies. Capital outflow, mounting debt pressure and financial market turbulence are all potential threats to infrastructure investments.

In light of the challenges and opportunities, Asian economies are ready for new solutions. The stages are set for a pan-Asian connectivity and multiple initiatives are in action. China put forward the Belt and Road Initiative (BRI) in 2013 which has made remarkable progress ever since. ASEAN countries adopt the Master Plan ASEAN Connectivity 2025 aspiring for a higher standard integration. The Eurasian Economic Union is under construction and the EU-Asia Connectivity Strategy has been launched since 2018. Asian economies are working together within and beyond the region on connectivity like never before.

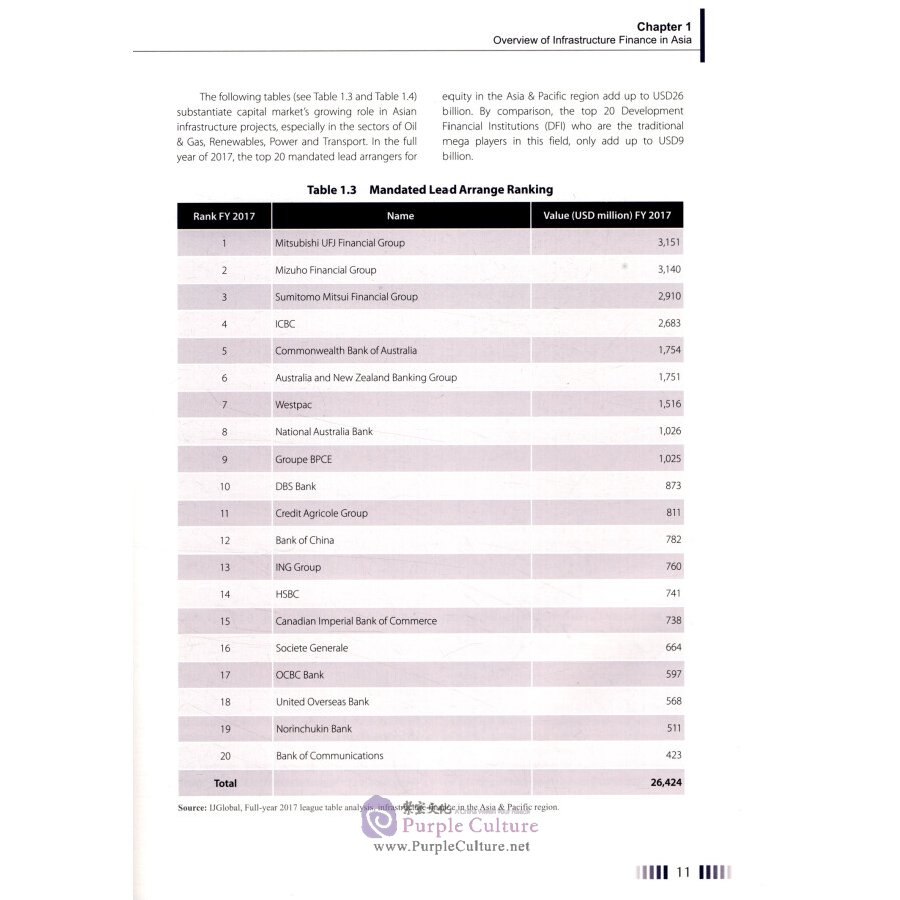

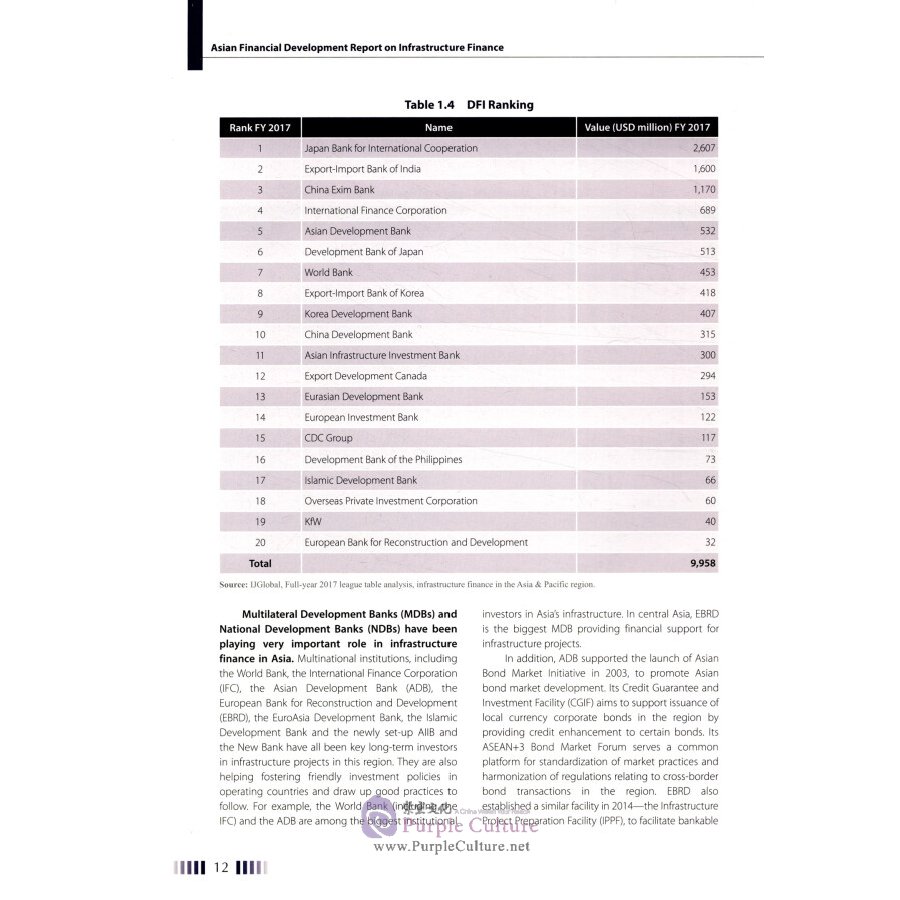

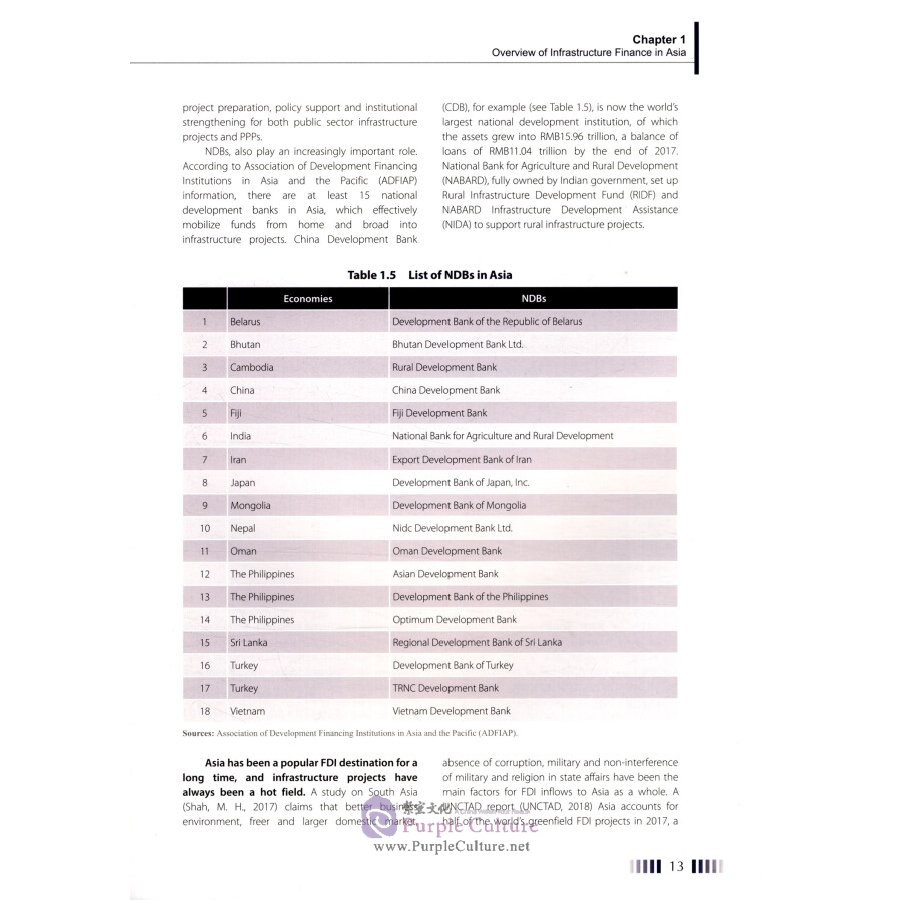

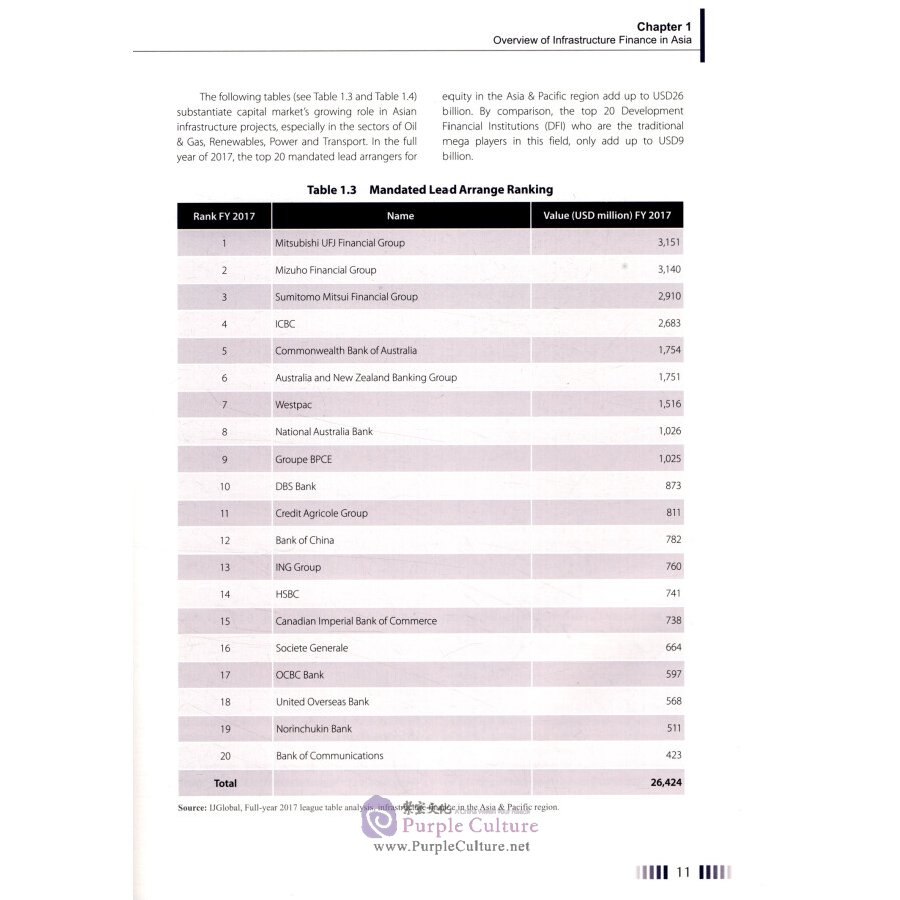

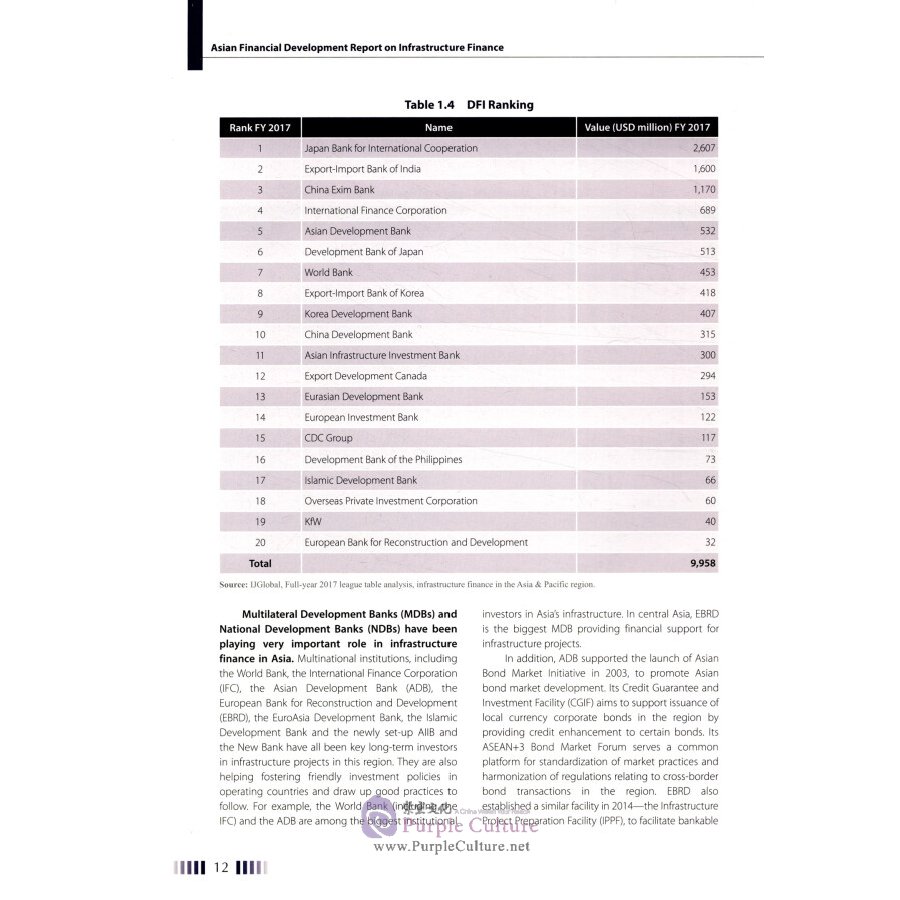

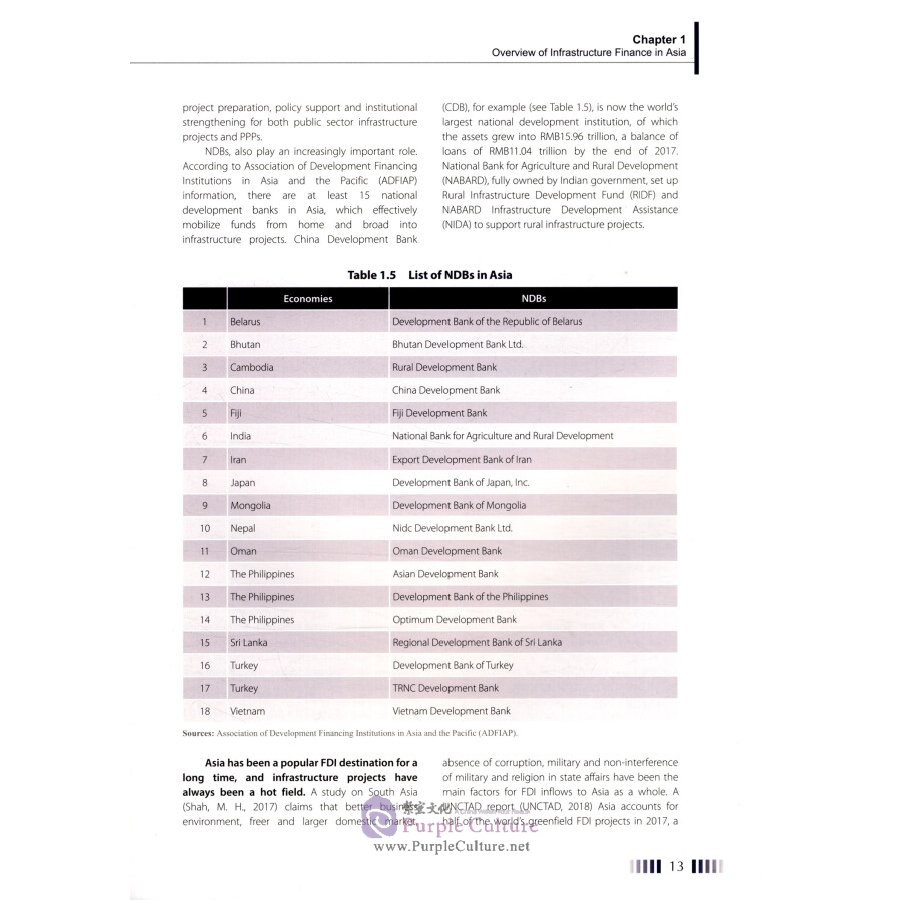

Against the backdrop of the ambitious connectivity plans, financing remains the bottleneck. Public finance remains to be the dominant source of infrastructure finance. Public-private-partnerships started playing more important roles, Multinational and national development banks continue to be vital players in this field. Policy coordination, investment environment, macroeconomic policies and local financial markets need to be strengthened to attract long-term investors from the private sector and better mobilize high savings from Asia itself.